FINANCE

It is the kind of software installed to store financial information of the business. In addition, it assists, manages and processes a set of financial transactions along with recording it. It can be included by executing it as a standalone system or by incorporating it into the financial information system. Sectors they are used to are as follows:

- Financial data management

- Account management

- Small business industries

- Financial transactions and management

Why choose finance software?

They can be extremely beneficial while managing your money and can help you keep track so that you do not end up in a situation, where you ask yourself “where did all the money go?” It also helps with management of budget which is absolutely important in the initial stage of setting up your business. Your bills, transactions, bills, and investments can be taken care of as well. And the obvious one, it reduces the risk of miscalculation.

How to choose the best finance software?

There are many options available for best finance software, and you have to find what fulfills your purpose the best. A few things can be kept in mind before making a purchase:

- Make sure that the program is efficient enough and runs smoothly and it meets your needs.

- It should be flexible and include more and more options and tools like telling loan rates, error checks, online filings, budgeting etc.

- Check how frequently the application updates the balances. Furthermore, it is important to know if it is generated automatically or manually.

- Most finance software has the feature of reminding for due dates, payments, and bills so know if yours include it too.

- Some applications let you store investment transactions and also keep the account values up to date so look for this feature. This would be beneficial for small as well as large business setups.

- Knowing net worth can be important for some and not all the finance software come with this option. If you think that might affect your business and this feature would be necessary then look for applications that offer it.

- If the purchase is to be made for a large banking company, then you might want to consider if the application can handle the accounts of multiple customers as it is easy to lose track if they are being recorded on excel sheets.

- Dealing with the type of currency also matters. If you deal with one or two types of currencies, then the application should be able to support it. All the applications do not come with this feature so have a look before purchasing it.

- Calculation of payroll, annual leave and service leave may be required in IT companies to take care of that.

- Some companies would like to keep detailed records.

- Costs, usability, and other conditions should also be considered while making a purchase

- Most importantly, the finance software should be user-friendly; you wouldn’t want to put too much time into understanding the system.

What are the different types of finance software?

According to your need, you can choose from the following types of finance software:

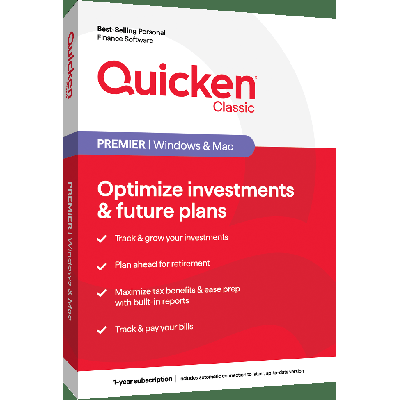

Investment

this type of finance software can be beneficial for people who would like to keep track of their investments, which include, retirement plans, and investments in the business etc.

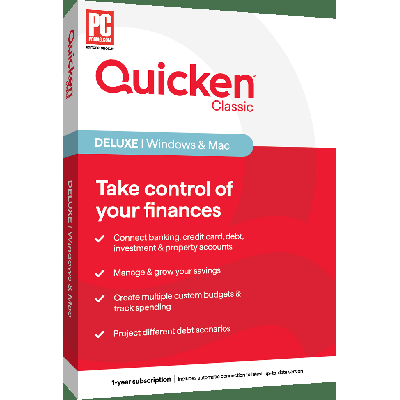

Bills

people who have trouble managing expenses and have frequent purchases to make can buy this type of software. It can also be used by people who function on a budget and have limited resources.

Savings

everyone wants to save money and it is advisable as an emergency situation may arise in future. If you want to monitor savings, such finance software is also available and also if you want it to include more features, then you can choose software which fulfills your other purposes.

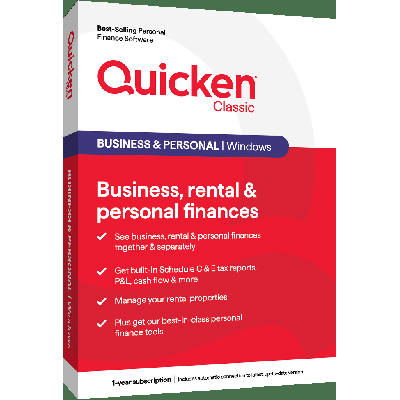

Multipurpose applications are also available which are suitable for financing companies.

With the above-mentioned points, one can easily understand which kind of software they require.